Complete Guide to Mortgages for the Self-Employed in Canada

- Norbert Olejnik

- Jan 6

- 5 min read

Being self-employed gives you freedom, flexibility, and control over your income — but when it comes time to apply for a mortgage, that same flexibility can feel like a disadvantage.

If you’ve ever been told “come back when you have two years of T4s” or felt your real income wasn’t being recognized, this guide is for you.

This is your complete, step-by-step guide to getting a mortgage in Canada as a self-employed borrower — including how lenders really assess your income, what documents you need, common mistakes to avoid, and the best mortgage options available today.

Table of Contents

Why Mortgages Are Different for the Self-Employed

Who Counts as Self-Employed?

How Lenders Assess Self-Employed Income

Mortgage Options for the Self-Employed

Required Documents Checklist

How to Improve Your Approval Odds

Common Myths About Self-Employed Mortgages

First-Time Buyers vs. Business Owners

Refinancing & Renewals When Self-Employed

Working With a Mortgage Broker

Frequently Asked Questions

Final Thoughts

1. Why Mortgages Are Different for the Self-Employed

Traditional employees have it easy: lenders look at their T4 and recent pay stubs. Self-employed borrowers? Not so much.

Lenders care about:

Stability

Consistency

Provable income

Because business owners often:

Write off expenses

Pay themselves irregularly

Reinvest profits

Use dividends instead of salary

…your taxable income may look much lower than what you actually earn — and that’s where most mortgage applications run into trouble.

2. Who Counts as Self-Employed?

You’re considered self-employed if you are:

A sole proprietor

A corporation owner (even if you pay yourself a salary)

A contractor or freelancer

Commission-based with no guaranteed income

Gig workers (Uber, DoorDash, etc.)

Professional service providers (realtors, consultants, trades, etc.)

Even if you receive a T4 from your own corporation, most lenders still treat you as self-employed.

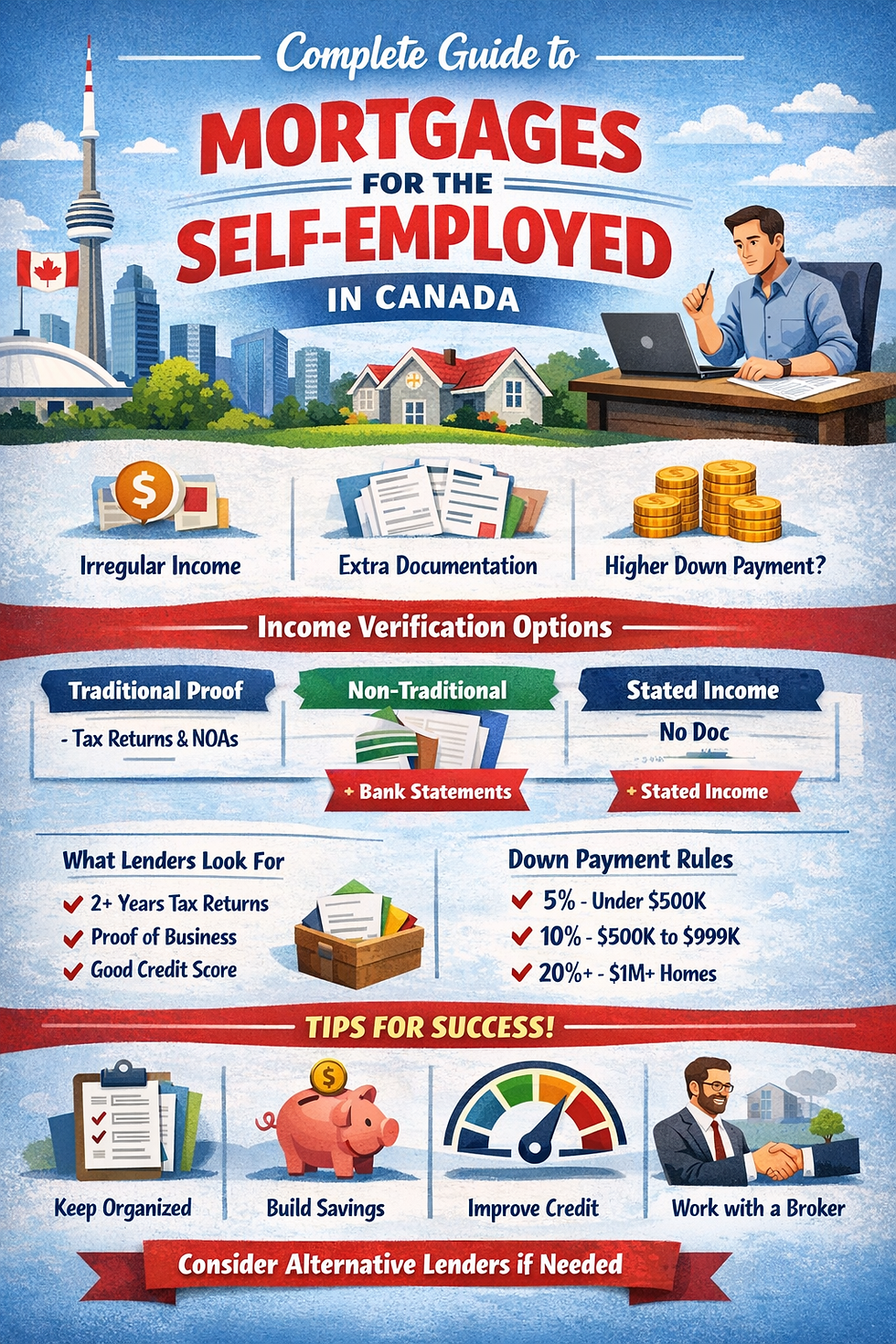

3. How Lenders Assess Self-Employed Income

There are three main ways lenders evaluate income:

1️⃣ Traditional (Prime) Lending

Banks use:

Last 2 years of personal tax returns

Line 15000 income

Business financials (if incorporated)

They usually average the last two years and want to see stable or increasing income.

2️⃣ Stated Income Programs

Available through:

Alternative (“B”) lenders

Some credit unions

Certain monoline lenders

Here, lenders look at:

Your industry

Your business bank statements

Your lifestyle and cash flow

Reasonable income estimates

This is ideal for business owners who write off a lot of expenses.

3️⃣ Bank Statement Programs

Some lenders allow:

6–12 months of business bank statements

Income is calculated based on deposits instead of tax returns

Great for:

Newer businesses

Cash-heavy industries

Seasonal earners

4. Mortgage Options for the Self-Employed

You’re not limited to just one path.

Prime Lenders (Big Banks & Monolines)

Best if you have:

Strong credit (680+)

Two years of solid income

Low debt ratios

Alternative (“B”) Lenders

Perfect for:

Business owners with write-offs

Inconsistent income

Short time in business (1–2 years)

Rates are slightly higher, but:

Approval is easier

Flexibility is greater

Often a stepping stone back to prime later

Private Lenders

Used when:

Credit is bruised

Income is hard to prove

Property value is strong

Short-term solution only — but can be a powerful strategy when used correctly.

5. Required Documents Checklist

While it varies by lender, expect some or all of the following:

Personal

Government ID

Credit report

Recent bank statements

Personal tax returns (2 years)

Notices of Assessment

Business

T1 Generals or T2s

Business financial statements

Articles of incorporation

Business license

GST/HST filings

Business bank statements

A good broker will tell you exactly what you need based on the lender path — not overwhelm you with everything.

6. How to Improve Your Approval Odds

Here’s what really moves the needle:

✅ Keep Personal Credit Strong

Pay bills on time, avoid maxing cards.

✅ Reduce Consumer Debt

Lower ratios = higher approval chances.

✅ Plan Ahead

Talk to a broker before tax season. Sometimes small tax-planning tweaks can mean a huge mortgage difference.

✅ Separate Business & Personal Finances

Clean financials build lender confidence.

✅ Work With a Specialist

Not all mortgage brokers understand self-employed files — this matters more than rate alone.

7. Common Myths About Self-Employed Mortgages

Myth #1: You need 20% down→ False. You can buy with as little as 5% down in many cases.

Myth #2: You need two full years in business→ Often true for banks — but alternatives can approve with 12 months or even less.

Myth #3: You’ll always pay higher rates→ Not necessarily. Many self-employed borrowers qualify for prime rates with the right structure.

Myth #4: You should claim more income just to get approved→ Dangerous. There are better strategies that don’t involve tax risk.

8. First-Time Buyers vs Business Owners

First-Time Self-Employed Buyers

Often struggle with:

Short business history

Smaller down payment

But benefit from:

Insured mortgage programs

Stated income options

First-Time Buyer incentives

Established Business Owners

More flexibility:

Equity options

Refinancing

Cash-out for investments

Can leverage:

Corporate income

Multiple properties

Portfolio strategies

9. Refinancing & Renewals When Self-Employed

Even if you already own a home, being self-employed matters at:

Renewal

Switching lenders may require full re-qualification.

Your income situation today matters — not five years ago.

Refinancing

Pulling equity for:

Business expansion

Debt consolidation

Investments

Often easier than a purchase because of:

Existing equity

Payment history

10. Why Working With a Mortgage Broker Matters

Banks have one box. Brokers have many solutions.

A broker who specializes in self-employed mortgages will:

Match your file to the right lender

Structure your income correctly

Save you time, stress, and rejections

Often get you approved when banks say no

The difference isn’t just approval — it’s approval on the best possible terms.

11. Frequently Asked Questions

Can I get a mortgage if I just became self-employed?

Yes. Some lenders accept as little as 6–12 months of business history depending on your industry and background.

What credit score do I need?

Prime lenders: usually 680+

Alternative lenders: 600+

Private lenders: case-by-case

Can I use corporate income?

Yes — many lenders will consider:

Salary

Dividends

Retained earnings

Gross business revenue (with programs designed for this)

Can I buy with less than 20% down?

Absolutely. Many self-employed borrowers buy with 5–10% down using insured or alternative programs.

12. In Conclusion

Being self-employed should not stop you from owning a home, growing your wealth, or refinancing strategically.

You just need:

The right strategy

The right lender

The right advisor

Mortgages for the self-employed aren’t harder — they’re just different. And when done correctly, they can be just as competitive as any traditional mortgage.

Your Business Is Unique — Your Mortgage Should Be Too

I specialize in helping self-employed Canadians:

Buy their first home

Move up

Refinance

Renew smarter

Access equity for business or investments

You don’t need to fit the bank’s box — you just need the right strategy.

👉 Book Your Free Self-Employed Mortgage Consultation

Norbert Olejnik Mortgage Specialist | Dream Key Mortgage📧 Norbert@dreamkeymortgage.ca